Fast Lanes and High Stakes: Trading Lessons from Formula Racing

Key Takeaways:

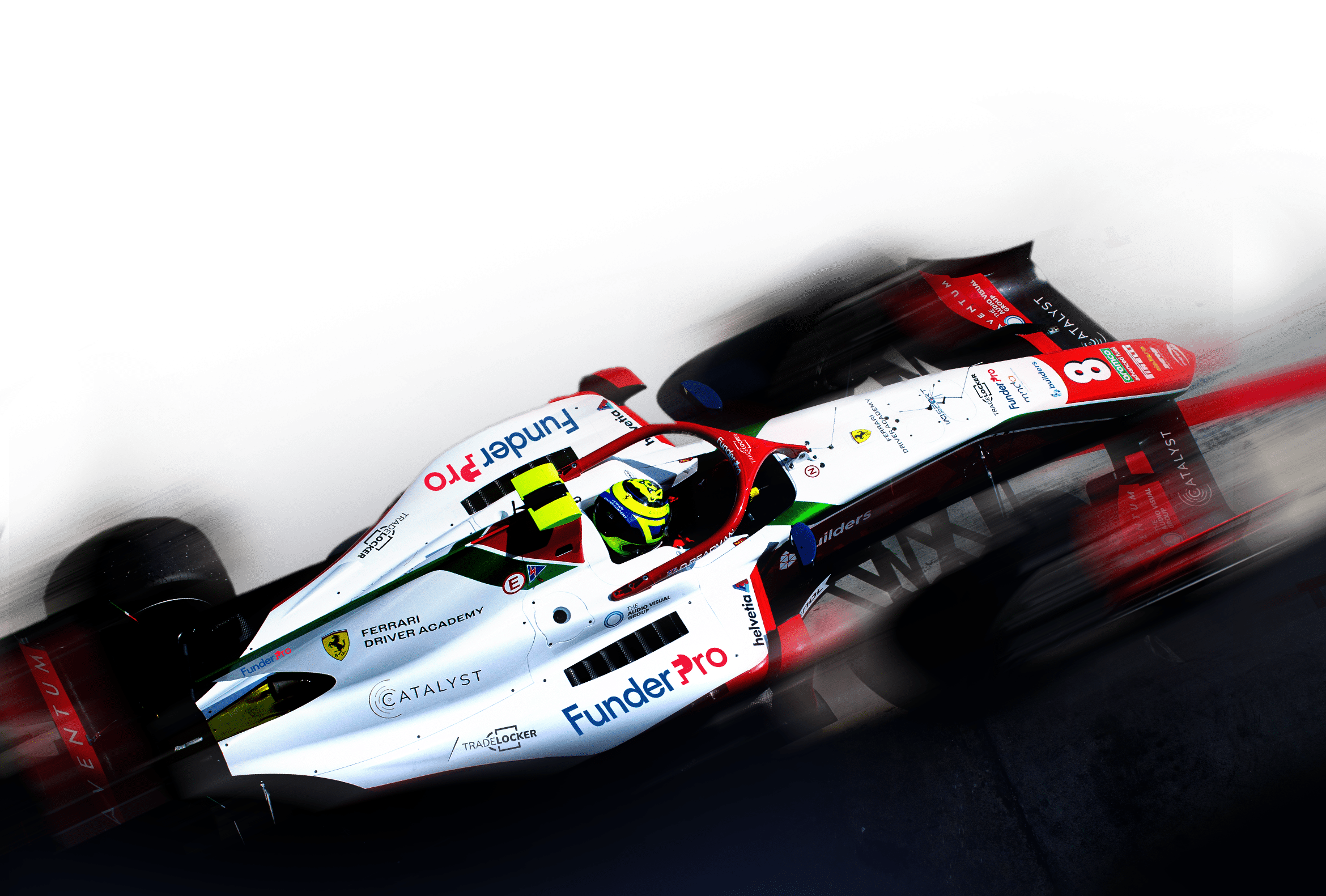

- Formula racing and FunderPro’s trading challenge are more alike than you might suspect.

- Reading the track is just as vital as reading the tape and razor-sharp focus is needed in both.

- Formula 2 racers like FunderPro’s partner Ollie Bearman share striking similarities to traders.

You’re moving fast, blowing past competitors, and aiming to be the first to zip through the finish line. It’s a high-stakes race and the prize is coveted by everyone with you in the arena. Care to guess what we are on about? Spoiler alert: it’s both Formula racing and FunderPro’s funded trading challenge. Now let’s get to the point.

These two operate in completely different industries. But they make an excellent pair to highlight what it means to go after your goals and hit one milestone after another. Plus, we also want to brag a bit about our partnership with racing juggernaut and Formula 1 Junior star Ollie Bearman.

What’s the common ground between Formula racing and the financial markets? A whole lot more than meets the eye.

Snap Decisions Built on Solid Experience

To get you started, both require lightning-fast decision-making but only after careful preparation. Picture yourself in the driver’s cockpit, hitting full throttle, firing on all cylinders. You wouldn’t dare to land a foot in the racing circuit unless you’ve spent hours and hours behind the wheel.

Entering the financial markets with no trading preparation is equal to stepping into the Formula race without knowing how to navigate your car on the track.

In Formula racing, a driver needs to hit each turn at just the right speed and angle to maintain maximum speed. In trading, a trader needs to carefully analyze the market to determine the right entry and exit points for each trade. A small mistake in either field can lead to undesired outcomes.

Clear Strategy and Sharp Focus

A well-crafted strategy is vital for the continued success of both the Formula racer and the market enthusiast. Formula racers need to know exactly when to accelerate and when to brake. Traders need to know when to buy, sell, or step back from the market.

Just like a Formula racer needs to be able to read the track and anticipate potential obstacles, traders need to be able to read the market and anticipate potential shifts in economic reports, monetary policy decisions, and price moves.

In Formula racing, the best racers are the ones who can stay focused and maintain their composure even under high-pressure situations. This is true for traders as well, as the ability to remain calm and composed in the face of market volatility can make all the difference.

Staying Ahead of the Pack

You stand a better chance of winning in both racing and trading when you are aware of the competition. More precisely, having a deep understanding of your rivals and how they perform in certain conditions will give you the edge you need to come on top of the game.

In Formula racing, that edge is knowing how the others respond to the track and where they may expose a weakness. The racer’s job is to figure out how to gain an advantage in such a moment.

In trading, moving fast is equal to opening and closing trades at the right time. To best do that, traders need to stay on top of industry news, in tune with charts and price moves, and in line with the overall market sentiment.

Risk-taking as the Way Forward

A driver who plays it safe may never take the lead, just as a trader who never takes a risk may never see boastful returns. Of course, the key is to take calculated risks – in racing, that means pushing the car to the limit without losing control, while in trading, it means making strategic trades that have a high potential for profit.

Risk is best measured as the probability of losing, compared with the chances of winning. In racing, losing can take various shapes, including getting disqualified over poor performance. In trading, you risk your capital against the chance of turning in gains to grow your account balance.

Ultimately, it comes down to the risk-and-reward ratio. But you don’t need to take outsized risks to reap outsized rewards. Quick thinking, precision, knowledge of the field and the competition, and a willingness to take risks will take you far in your trading endeavors.

One Key Difference: Time

Among the similarities, we need to mention a key difference that sets Formula racing and FunderPro’s trading challenge apart. To many, this feature may very well be the game-changer in their trading.

It’s time. In Formula racing, drivers like Ollie Bearman (did we mention we partnered up?) will tell you that dashing through the circuit is what makes winners and brings championships. If you don’t make it in time, you’re out.

With FunderPro’s funded challenge, however, the old finance adage holds true: time in the market is better than timing the market.

Our trading challenge’s edge is the unlimited time to pass it. No matter what happens, or doesn’t happen (we all know the dry spells markets can throw at us), you don’t need to rush your trades. You can sit tight and watch thousands of price moves – you have the freedom to wait for the perfect trade setup before you decide to enter the market. And that’s what separates FunderPro from the competition.

Conclusion

In the end, Formula racing and trading are both about pushing yourself to be the best you can be. So if you’re thinking about trying your hand at FunderPro’s trading challenge, remember: it’s a lot like Formula racing, except instead of a steering wheel, you’re using your financial acumen to navigate the twists and turns of the market. And instead of a nerve-racking countdown, you get unlimited time to unpack your skills and snatch the opportunities when they arise.

Ready to take the challenge? Sign Up Now.