Careers at FunderPro

Join a fast-moving team that’s building powerful tools and funding real talent. Ready to make an impact? Your journey starts here.

Why Choose Us?

The thrill of a startup, the stability of an established brand.

Innovative Work Environment

We foster a culture of innovation, where employees are encouraged to think creatively and develop groundbreaking solutions. This dynamic environment keeps work exciting and fulfilling.

Career Growth Opportunities

We are committed to the professional development of all employees, offering clear pathways for career advancement, continuous learning programs, and opportunities to take on new challenges.

Collaborative Team Culture

At FunderPro, teamwork is at the heart of our success. We value collaboration, mutual respect, and the sharing of ideas, creating a supportive environment where every team member can thrive.

Competitive Benefits

We believe in rewarding our employees for their hard work and dedication. FunderPro offers competitive salaries, comprehensive benefits packages, and performance-based incentives.

Work-Life Balance

We offer flexible working hours, remote work options, and a supportive environment that values your personal time and well-being.

Commitment to Diversity

We are dedicated to building a diverse and inclusive workplace where everyone feels valued and respected. We believe that this brings a variety of perspectives, driving innovation and success.

Open Positions

What's It Like to Work for FunderPro?

Hear directly from the team that makes FunderPro what it is. People from all over the world, coming together to bring you the best prop experience.

Hybrid or Remote

Our headquarters are based in the vibrant city of Limassol, Cyprus but our team works from anywhere. Whether you’re by the sea, in the mountains, or in a bustling city, we believe great work isn’t limited by location. We embrace flexibility, remote collaboration, and a global mindset to build something exceptional together.

We’re always on the lookout for passionate people.

If you didn’t find a role that matches your skills, just drop your details and upload your CV.

We’ll reach out when something fitting comes up.

Didn’t Find the

Right Role?

We’re always on the lookout for passionate people. If you didn’t find a role that matches your skills, just drop your details and upload your CV. We’ll reach out when something fitting comes up.

Hybrid or Remote

FunderPro’s opportunities span across countries and locations. Employees can work remotely, hybrid or come to the office. Do what makes you perform!

SPAIN ITALY UNITED KINDGOM AMERICA BRAZIL DENMARK CROATIA MALTA IRELAND ARGENTINA EGYPT COLOMBIA SOUTH AFRICA

Hybrid or Remote

FunderPro’s opportunities span across countries and locations. Employees can work remotely, hybrid or come to the office. Do what makes you perform!

Main Office

Silema, Malta

Level 4, 196, Triq Censu Tabone, Saint Julians, Malta

Main Office

Limassol, Cyprus

Spyrou Kyprianou 82, 4th Floor, Potamos Germasogeias, 4042, Limassol, Cyprus.

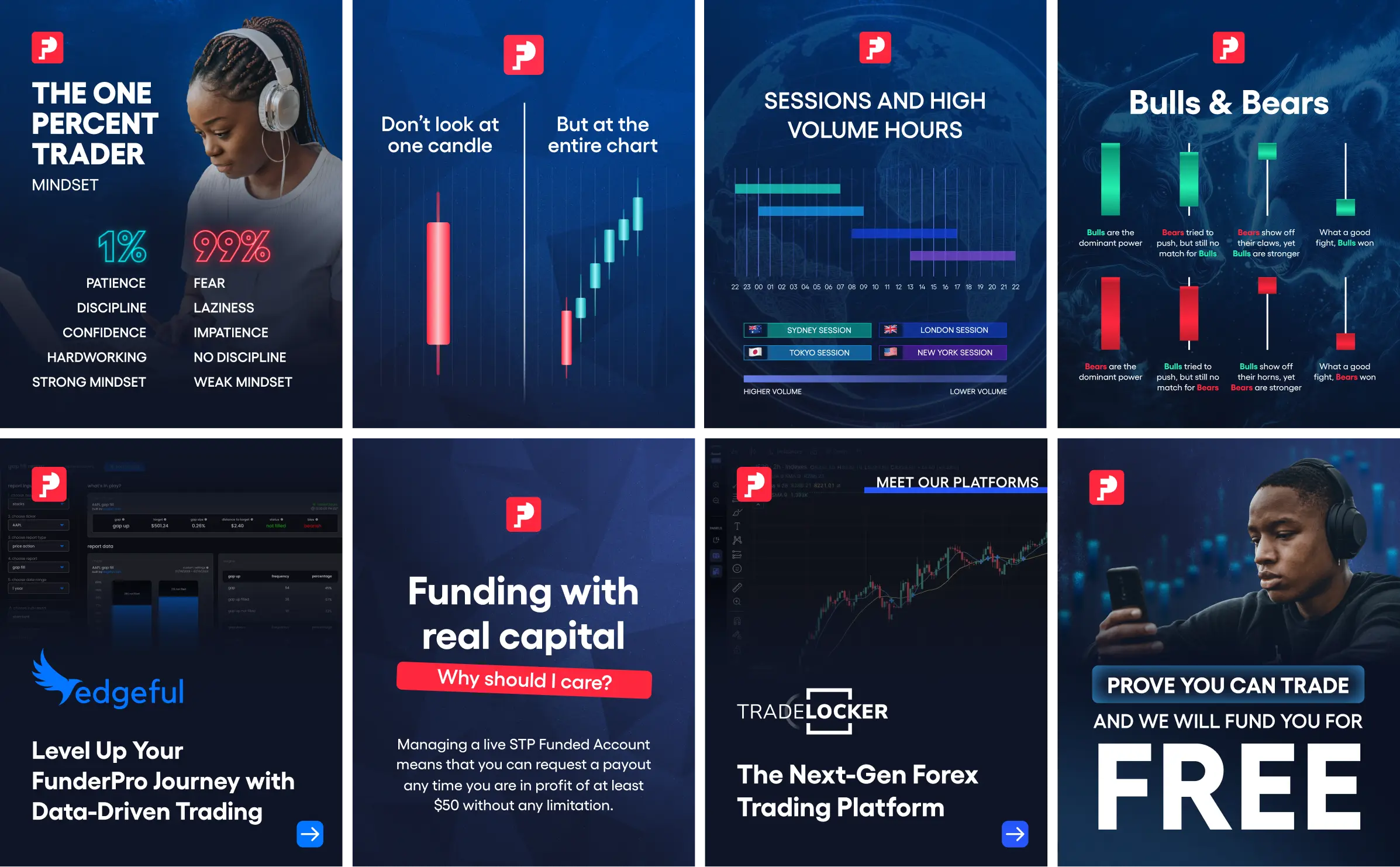

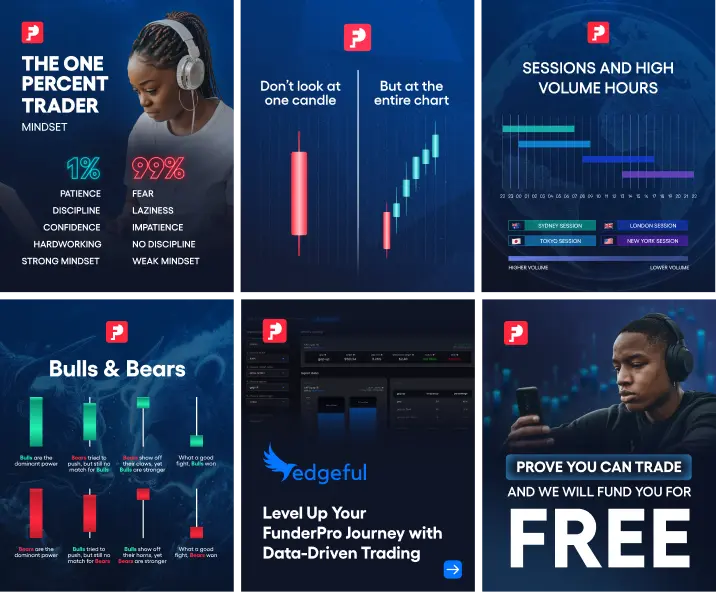

Who We Are

At FunderPro, we’re on a mission to empower skilled traders by providing access to capital, cutting-edge tools, and a supportive environment for growth. Backed by transparency, innovation, and a commitment to excellence, we help traders unlock their full potential and succeed in the world of proprietary trading.

“Our goal is to find talented traders and fund them with large trading capital. As a FunderPro Funded Trader, traders can earn more than they would by trading their own money.”

“Our philosophy is to give all talented traders real capital and issue payouts every time they generate profit. Only this will establish proprietary trading as a viable business model that everybody can benefit from and is sustainable in the long run.”