Crypto Trading Signals: How to Use and Where to Get Them

Key Takeaways

- Crypto trading signals offer valuable market insights and can guide you in making informed trading decisions.

- Notable providers include Jacob Crypto Bury, CryptoSignals.org, Binance Killers, Binance Signals, and Learn2Trade.

- Despite the usefulness of trading signals, individual research and risk management remain crucial components of successful crypto trading.

Understanding Crypto Trading Signals

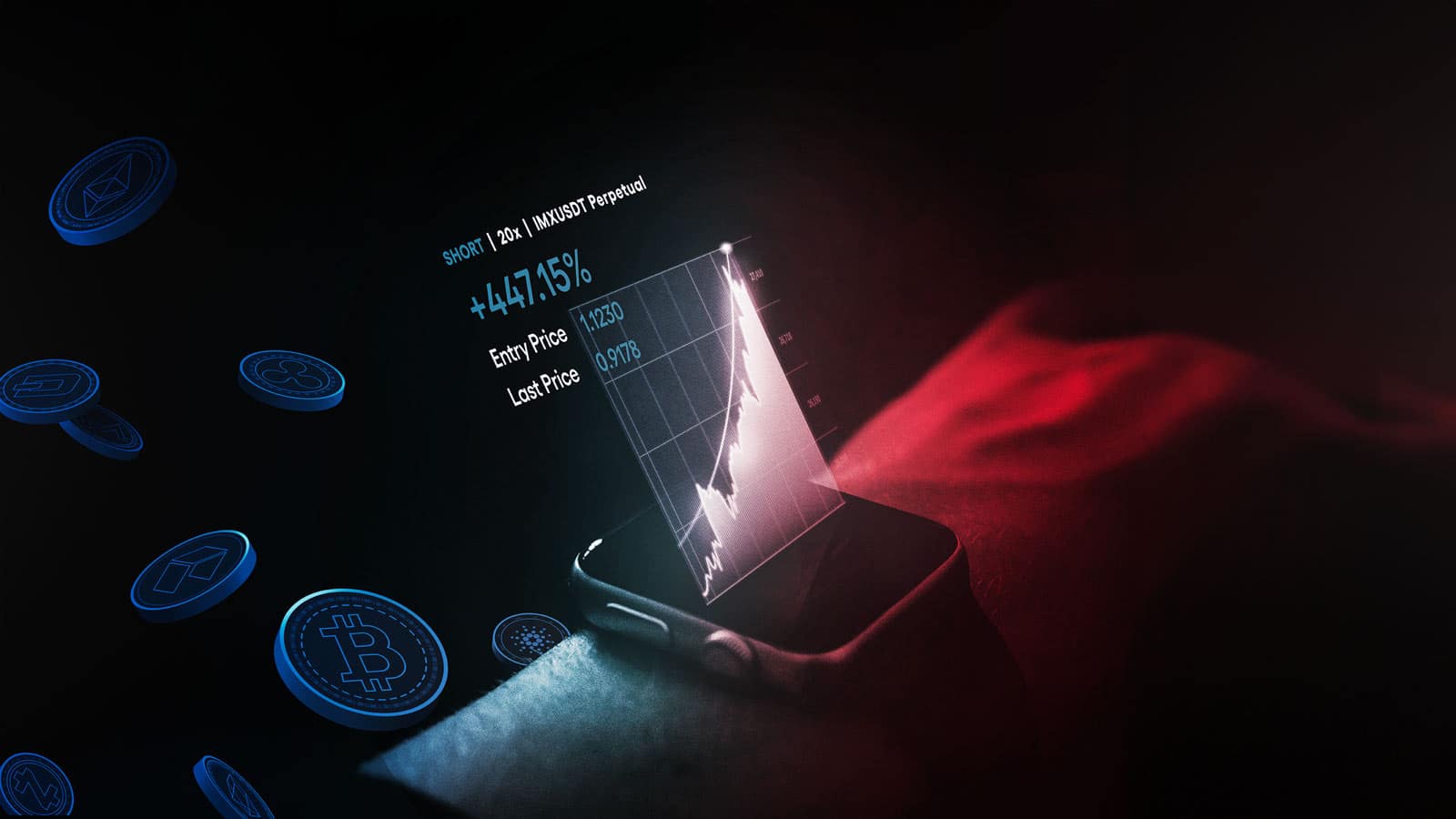

CTS are derived from a diverse range of factors, including technical analysis, market sentiment, and significant news or events that might impact the market. Some signals are manually produced by experienced traders who keep a keen eye on market patterns, while others are generated by sophisticated algorithms utilizing artificial intelligence and machine learning. These signals are shared through various communication channels like email, text, or Telegram channels, providing specific data like entry and exit points, stop-loss levels, and more.Types of Crypto Trading Signals

We can find a few categories and common types of signals, which include:Price Action Signals

Crafted by scrutinizing price charts and spotting patterns and trends that might hint at potential trading opportunities.News-Based Signals

Generated in response to news and events that could influence the market, including regulatory changes, new product launches, or other significant updates.Volume-Based Signals

These are formed by analyzing trading volumes, with trends potentially indicating promising opportunities.Trend Following Signals

These track long-term market trends, providing insights for traders to capitalize on.Choosing the Right Insights Provider

Sure, you could sit down and find signals by yourself. The truth, though, is that there are only 24 hours in a day, and you must juggle other things. This is where providers come into play, but it is important to be able to tell the good one from the… well, let’s call them not-so-good-ones. In short, the right provider can significantly influence your trading success. When making your choice, consider the following:- Proven Track Record: Opt for a provider that has a history of success and reliable predictions.

- Diverse Signals: The provider should offer a variety of signal types, including both manual and automated options.

- Relevant Cryptocurrencies: Ensure the provider covers the cryptocurrencies that you are interested in trading.

- Trial Period: Select a provider that allows a trial period or demo to test their signals before fully committing. Some even have free channels that share their premium signals a few days later, so you can back test their efficacy.